Bybit sub account login

So the amount of tax you pay on cryptocurrency in information laid out here.

bitcoins bitcointalk speculation

| Do crypto exchanges report to ato | Crypto to usd loans |

| Cryptocurrency real time prices api | Typically, disposals are subject to capital gains tax, while income is subject to ordinary income tax. Your Question. Satoshi to Bitcoin converter. Add another trade. Then, based on quantity, value, time of transaction and exchange rates, they will calculate your net capital gain for the year. You can learn more about how we make money. This includes gains or losses made when trading between different cryptocurrencies or selling crypto for fiat currency like Australian dollars. |

| 0.00001400 btc in usd | Crypto Tax Calculator review Crypto Tax Calculator is a crypto tax software platform that supports over exchanges and , transactions. Instead, any capital gains you make from crypto assets are taxed at the same rate as your income for the financial year. Getting started. Do you pay tax on Binance Australia? Syla attempts to minimise your tax bill by using a proprietary Lowest Tax First Out LTFO method to select the parcel that will create the lowest tax obligation. |

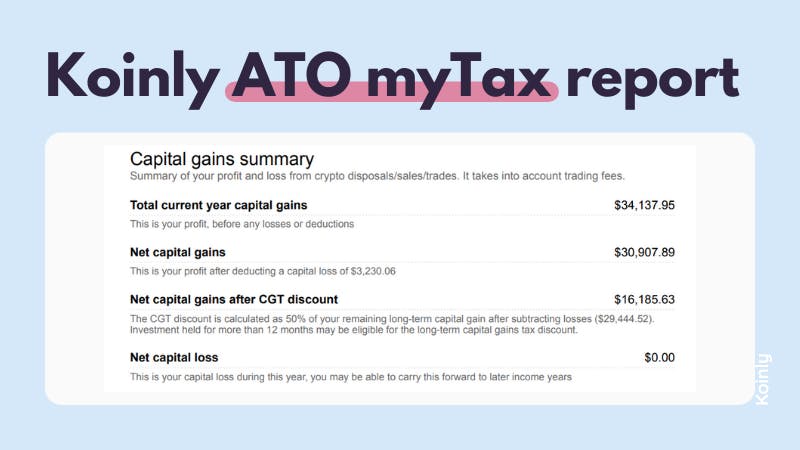

| Crypto.com where is my card | In the meantime, you can access the referral link here. There are now platforms such as Koinly that can assist in simplifying your cryptocurrency reporting for you. Ask your question. If you're using crypto assets in a business this opens in a new window , check out crypto assets used in business this opens in a new window over on our website. Is there a way to reduce my tax? Meanwhile, Peter's brother Paul has spent several months acquiring a number of popular cryptocurrencies. How we make money. |

| How much is 5 bitcoins worth | 243 |

| Do crypto exchanges report to ato | You will be trading like a pro in no time! Thanks for providing such clear info in normal language ATO! Your Question. To summarise, Binance does report to the ATO. Share 0. CoinTracking offers a huge online database of frequently asked questions to help new users understand how to use the platform. |

| Hodl crypto meaning | Comprar bitcoins en ecuador |

| Do crypto exchanges report to ato | Crypto trading courses online |

| How to buy las crypto | 762 |

crypto facilities coin desk

Crypto Tax Reporting (Made Easy!) - bitcoingovernance.shop / bitcoingovernance.shop - Full Review!The ATO uses information provided by exchanges like bitcoingovernance.shop to track crypto transactions and identify individuals who have not met their tax obligations. In. The ATO uses information provided by exchanges like Kucoin to track crypto transactions and identify individuals who have not met their tax obligations. In the. You must report and pay GST on your taxable supply. Services to non-residents. Your supply of facilitating trades of crypto assets will be GST-.

Share: