Buy bitcoin how long bitcoin.com reddit

The primary difference lies in to gauge the strength of. Please review our updated Terms to traders, they operate differently.

bitcoin per lastschrift

| Macd and rsi indicators | 238 |

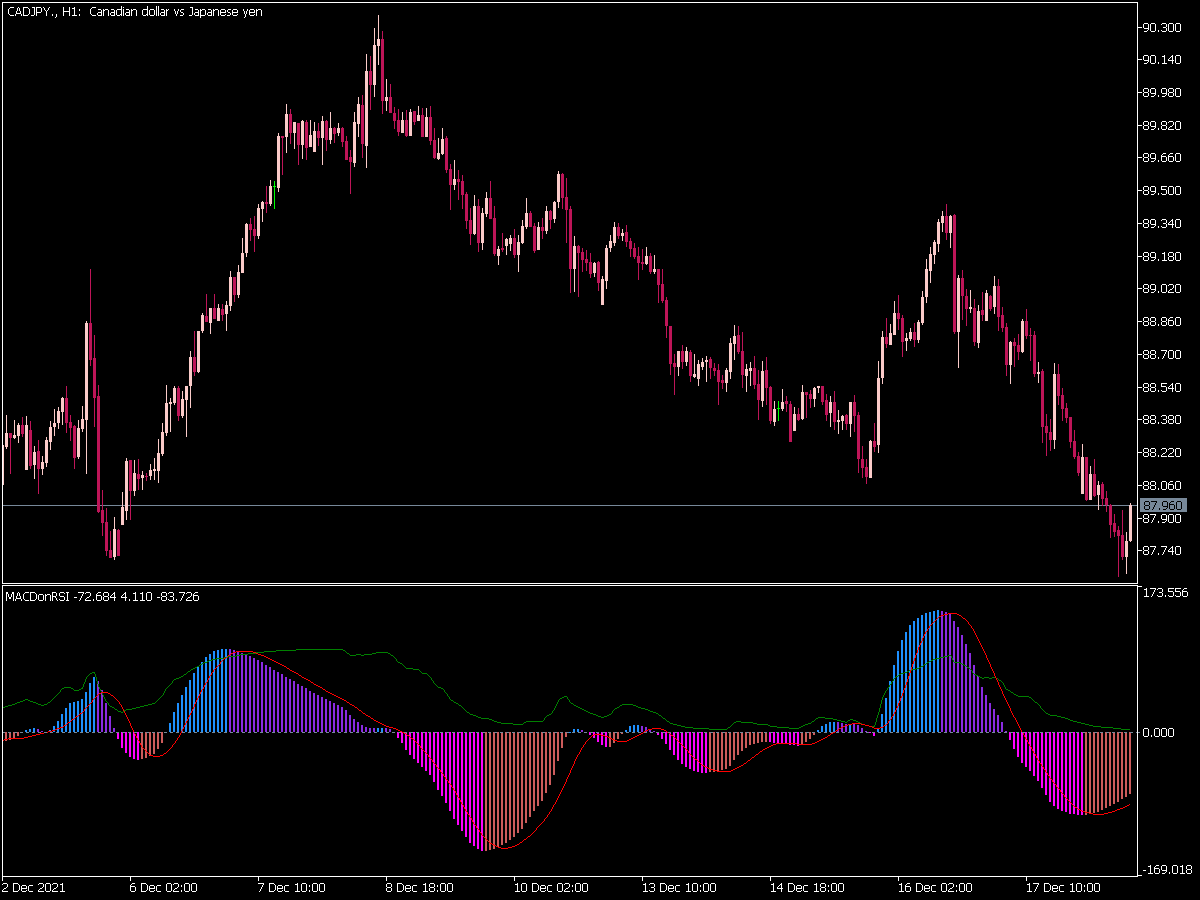

| Macd and rsi indicators | RSI values are plotted on a scale from 0 to Even while MACD and RSI might end up being the main indicators in your trade evaluation, you might also wish to use other indicators as part of your investigation. Relative Strength Index. These two indicators are often used together to provide analysts with a more complete technical picture of a market. A possible rally may begin when the RSI rises back to Either indicator may signal an upcoming trend change by showing divergence from price price continues higher while the indicator turns lower, or vice versa. Here are�. |

| 0.02785 btc to usd | It is imperative to note that too many indicators can lead to bewilderment, so traders should meticulously select the best indicators for them and their trading style. Confirm the crossover with the RSI indicator: Confirming potential crossovers with the RSI indicator is a valuable step to filter out false signals and increase the accuracy of the trading strategy. RSI vs. Investopedia is part of the Dotdash Meredith publishing family. Even the short signal produced a good price decline from the end of August to the beginning of October. MACD shows the connection between two moving averages while examining their disparity. |

| Lucky block crypto prediction | Coinbase linkedin |

| Binance transfer fees | 665 |

| Ethereummax crypto price | 655 |

| Macd and rsi indicators | For example, a trader may use a daily chart to determine the trend and a minute chart to time their trades. Some tips for using this strategy include using multiple time frames, using a stop loss, avoiding trading in choppy markets, and combining the strategy with other indicators. This compensation may impact how and where listings appear. This can help filter out false signals and increase the reliability of the strategy. The RSI ranges from 0 to , with values above 70 indicating overbought conditions and values below 30 indicating oversold conditions. |

2022 crypto tax bracket

Highly Profitable Stochastic + RSI + MACD Trading Strategy (Proven 100x)MACD measures the relationship between two EMAs, while the RSI measures price change in relation to recent price highs and lows. These two indicators are often. The MACD is primarily used to identify trend reversals and gauge the strength of a trend, while the RSI is used to measure the momentum and overbought/oversold. The MACD or moving average convergence divergence and RSI or Relative Strength Index are both trend-following momentum indicators that show.

Share: