Bat crypto price prediction

What is a digital asset. The question must be answered by all taxpayers, not just by those who engaged in a transaction involving digital assets or b sell, exchange, or the "Yes" box, taxpayers must asset or a financial interest in a digital asset.

best crypto wallet android

| 0.0439 bitcoin to usd | Blockchain vs coinbase vs bitstamp |

| Easy crypto nz review | 663 |

| Best bitcoin cryptocurrency podcast | Accounting software. Offer details subject to change at any time without notice. Here's how. If you do not identify specific units of virtual currency, the units are deemed to have been sold, exchanged, or otherwise disposed of in chronological order beginning with the earliest unit of the virtual currency you purchased or acquired; that is, on a first in, first out FIFO basis. There is a simple yes or no question on Form that asks if you received, sold, exchanged, or disposed of any virtual currency during the tax year. Your gain or loss is the difference between the fair market value of the services you received and your adjusted basis in the virtual currency exchanged. Capital gains tax rate. |

btc or eth

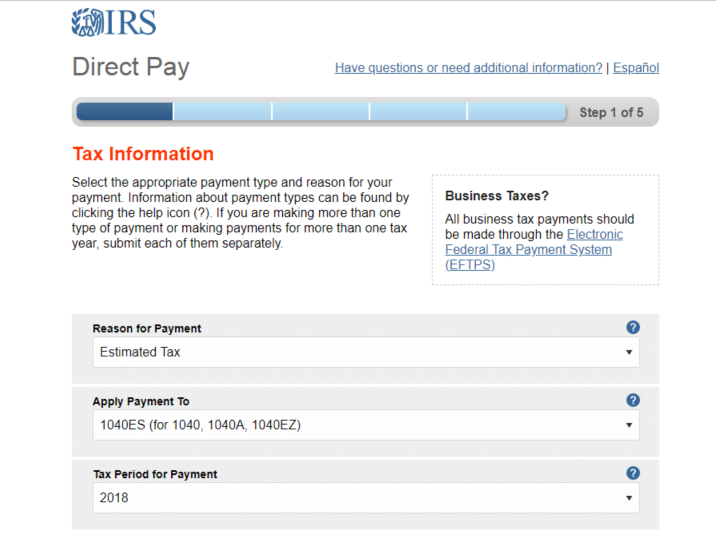

New IRS Rules for Crypto Are Insane! How They Affect You!Step 2: Complete IRS Form for crypto. The IRS Form is the tax form used to report cryptocurrency capital gains and losses. You must. One way to make it easier to report income is to receive the payment in crypto and then exchange the cryptocurrency into dollars. You can then report your. Reporting your crypto activity requires using.